Cost of College

April 29, 2015

Around this time, seniors at every high school have received, or are receiving, college replies about admission. For those that have gotten a good word from their dream college and are going to commit there, congratulations. However, for the people who cannot decide on where to go, here is a tip: do not let the cost sway your decision.

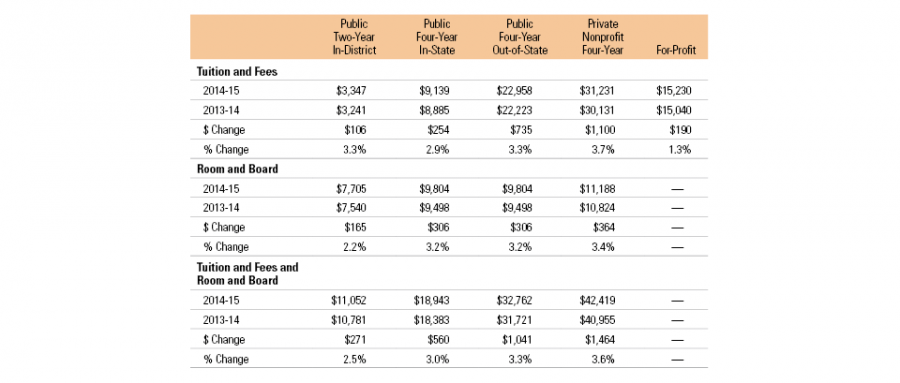

As most people know, the cost of college is very expensive. According to collegeboard.org, the average yearly tuition fees are $3,347. The public four-year college average yearly tuition fee is $9,139 for in-state and $22,958 for out-of-state. Private schools’ tuition averages around $31,231 every year. For many families, it is difficult to afford the cost of tuition. However, there is a way for undergraduate students to afford college. Colleges give out financial aid to each student to assist them in attending their school. To apply for financial aid, one must complete the FAFSA application and send it to their desired college(s). Colleges look at these and determine the financial package for the student corresponding with the application.

As the word ‘average’ implies, tuition can vary due to these financial packages. It is possible to have financial aid which can lower the Expected Family Contribution (EFC) below the average. It is also possible that the school can completely waive tuition for a student. It all depends on the families’ yearly income. Based on this yearly income, people can either pay $22,000 or can pay $2,000.

There are other ways that people can lower, if not completely waive, the cost of college. Scholarships and grants are one of the most well-known methods of affording college. Grants are funds that the federal government or private organizations give out to students they believe are qualified. One example of a grant is the Pell Grant. According to scholarships.com, “Students with high financial need may be eligible to receive Federal Pell Grants, the most popular federal grant given primarily to low-income undergraduate students”. The best thing about grants is that it is essentially free money, so it does not have to be paid back.

Scholarships are the same as grants in that it is free money. They can be awarded for pretty much anything. For example, there are scholarships for just being a certain race. On schoolguides.com, it says that scholarships can be awarded from academics to unusual aspects, such as being “a left-handed student” or someone “who can create the best prom dress out of duct tape”. All people have to do is search for scholarships online. On our school website, birminghamcharter.com, you can find different scholarships under the College/Career Center tab.

If that still does not cover the expenses, undergraduates have the option for loans. Studentaid.ed.gov states that there are three types of loans: direct subsidized, direct unsubsidized, and direct PLUS loans. A direct subsidized loan is an aid where the school will lend a student money in which they have to pay it back. However, unlike the unsubsidized loan which charges rates while students are still in college, the subsidized loan starts charging rates after the student leaves the school. PLUS loans, as studentaid.ed.gov states, “are federal loans that graduate or professional degree students and parents of dependent undergraduate students can use to help pay education expenses.” Though loans may seem to look overwhelming due to the fact that one must pay it back, if one is successful in college and attains a career, they can pay it back.